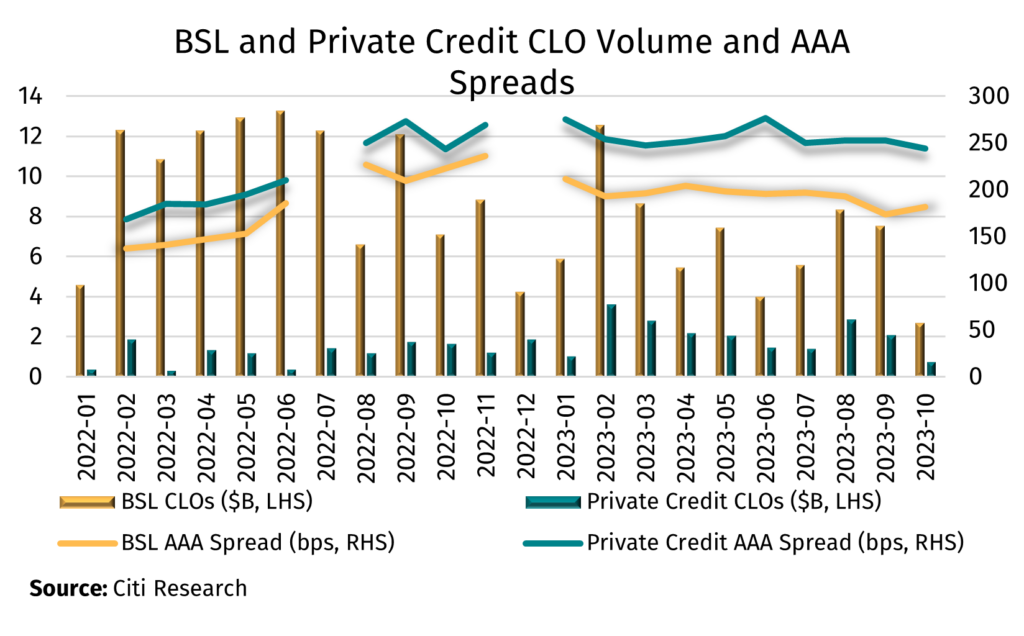

October 25, 2023 - Since the Federal Reserve kicked off its rate hike campaign last March, the “when-one-door-closes-another-one-opens” dynamic of the broadly syndicated loan and private credit markets has been on display in the CLO universe. Year-over-year, in the year-to-date through September, BSL CLO volume has fallen 33% while private credit CLO issuance has doubled, according to Citi Research. To put a finer point on it, private credit CLO YTD volume is tracking 40% ahead of its full-year 2022 volume.

Sure, there are technical reasons behind the issuance trends other than a BSL primary market that has been supply starved at frequent intervals over the past 18 months, and more growth (read: competition) coming from private credit. For instance, unfavorable arbitrage helped to chill BSL CLO issuance, while private credit CLOs, often used as vehicles to transfer existing loans from the balance sheet to free up capacity for more lending, are less dependent on arbitrage economics given their managers in many cases retain the equity (if not some of the other junior tranches). This suggests that the private credit CLO machine may continue to operate across the credit cycle.

Average AAA spreads in both instances, meanwhile, began to gap out following the Fed’s initial rate bump, with BSL CLO spreads peaking in October of last year at 236 bps (compared to 141 bps in March 2022) and private credit CLO spreads reaching their zenith in January of this year at 275 bps (compared to 185 bps in March 2022), Citi Research shows.

In a show of recovery, BSL CLO AAA spreads averaged 174 bps in September, but have widened out in the beginning of October to 182 bps. Private credit CLO AAA spreads, too, came in from their peak, but less than their BSL peers. Average private credit CLO AAAs spreads registered at 253 bps in September, unchanged from August. Also noteworthy, Golub Capitalin Septemberprinted a $1.33 billion private credit CLO – the largest new deal to price in three years – with AAA spreads at 235 bps. This played in a role in keeping the September average flat from the prior month given the deal represented about 65% of September volume. Of course, with lower volume, the spread of any one private credit CLO can materially shift the average.

But unlike BSL CLOs, average private credit AAA spreads tightened further in the beginning of October, to 244 bps. Relative to their peaks, BSL and private credit CLO average AAA spreads have pulled back 63 and 22 bps through September, respectively. That said, they are still 44 bps and 75 bps wide of levels prior to the start of the Fed’s shift in monetary policy, respectively. All of this is to say that a AAA spread premium is given to the private credit CLO market, reflective of its limitations in diversification, liquidity, and ratings transparency. But the premium has not moved in lockstep with the changes in the respective AAA spreads. Private credit CLO AAA spreads haven’t always softened as much as BSL CLO AAA spreads, or sometimes they’ve tightened more. This inconsistency has resulted in a spread premium over the last 18 months that has ranged from its tightest – 21 bps in October 2022 – to its widest – 81 bps in June 2023. As of October 13, the premium stands at 62 bps, up from 31 bps in February 2022, according to Citi Research.