September 20, 2018 - Despite its August publishing date, there was a considerable coverage of Moody’s recent recovery jeremiad. For those who were engrossed in beach reading and missed the report, Moody’s observed that liquidity is strong today, the U.S. economic outlook is bright and default rates are expected to decline over the coming year. However, when defaults do emerge, recovery given default (RGD) is likely to be lower. This is due to looser documents that could allow borrowers to stretch more debt over less (or migrating) collateral, a lack of maintenance covenants that will extend the time it takes lenders to get back to the table, and a decline in subordination that should mean lower RGD for loans. And there is specific feedback on covenants as well. Specifically, Moody’s notes that it utilizes a 50% family recovery rating for structures with first-lien debt that is covenant lite and an above 65% family recovery mean when first-lien only structure includes financial maintenance covenants.

That was last month’s news. What is new today? Covenant Review, which does not necessarily disagree with the future recovery outlook, dug a little deeper into the recovery experience of covenant lite loans. Specifically, Covenant Review looked at companies that originated debt after 2009, and subsequently defaulted and emerged from bankruptcy. All told, Covenant Review tracked 29 fully covenanted and 26 cov-lite loans that met this criteria. While the dataset is limited due to a paucity of defaults, some directional data has emerged.

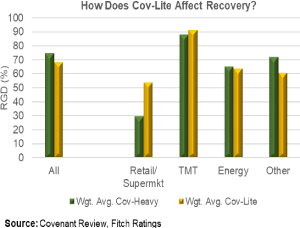

So how did covenant lite loans fare? Admittedly, on a limited dataset, not that badly. On average, recoveries of covenant lite loans were about 6.5 percentage points below their fully covenanted brethren. As the nearby chart indicates, covenant lite average and weighted average  recoveries were 64.6% and 68.1%, respectively. Covenant heavy average and weighted average recoveries were 71.3% and 74.6%, respectively. Of course, said chart also shows that there was a very wide dispersion around the mean. For instance, consider the limited set of six retail and supermarket companies in the dataset. To be sure, that sector has been facing existential threats – and it shows in the data. The weighted average recovery of fully covenanted retail companies was 30 (over 40 points below the average recovery), while retail’s covenant lite loans saw a 54 cent recovery (more than 10 points below the average recovery). Ultimately, while covenant lite loans did see lower recoveries, it appears that perhaps it was the company (and the sector) that made the bigger difference.

recoveries were 64.6% and 68.1%, respectively. Covenant heavy average and weighted average recoveries were 71.3% and 74.6%, respectively. Of course, said chart also shows that there was a very wide dispersion around the mean. For instance, consider the limited set of six retail and supermarket companies in the dataset. To be sure, that sector has been facing existential threats – and it shows in the data. The weighted average recovery of fully covenanted retail companies was 30 (over 40 points below the average recovery), while retail’s covenant lite loans saw a 54 cent recovery (more than 10 points below the average recovery). Ultimately, while covenant lite loans did see lower recoveries, it appears that perhaps it was the company (and the sector) that made the bigger difference.