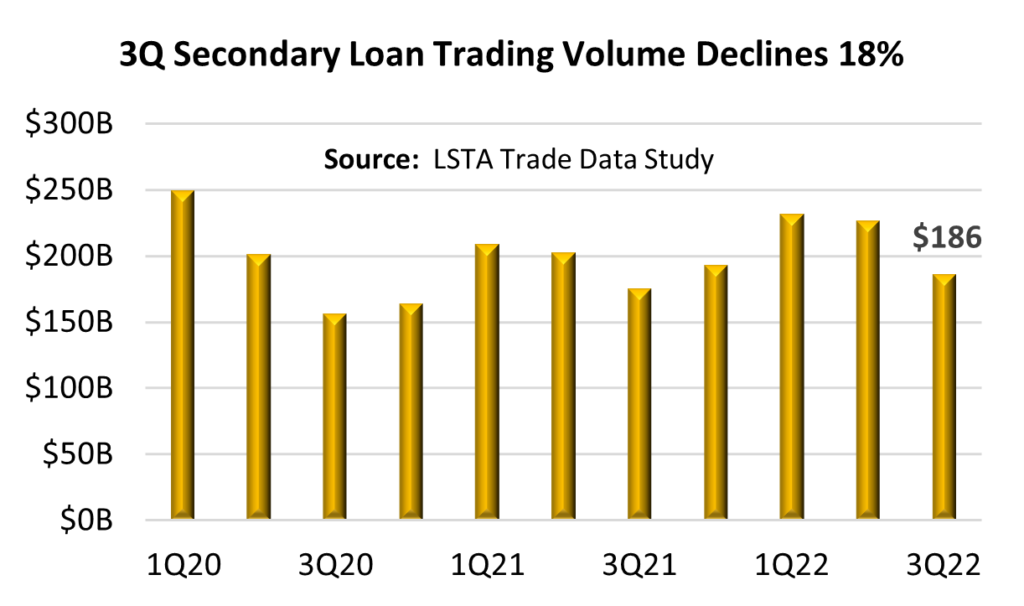

October 27, 2022 - Third quarter LSTA secondary trading volume fell 18% to $186B but increased 6% over the same time last year. This is not a new trend though; volumes almost always decline during the third quarter, particularly during July and August with a rebound in September. While monthly volumes did rise 11%, to $68B, in September, one might have expected to see a larger number considering the sell-off that ensued across the secondary market. There is, after all, a long-standing correlation between downward price volatility and increased trade activity. In September, the Morningstar/LSTA Leveraged Loan Index reported a market value loss of more than 2% for the third time this year, with the other two months being May and June. In looking back, we find seasonality and volatility combining to dictate trading activity over the past several months. Following the challenging two-month stretch between May and June, where loans sold off sharply, prices rebounded in July and rallied further in August, to only drop yet again in September. The stats? During the “sell-off” period of May and June, trading volumes averaged $76.2 billion per month. During the rebound period” of July and August, trading volumes averaged just $59B per month – a decline of 23% from the earlier months. In comparison, September volumes were 11% lower than the previously mentioned “sell-off’ period of May and June – despite a market that was just as volatile. While a lack of new deal flow and decreased visible demand levels certainly contributed to third quarter’s outsized decline in trade activity (and a comparatively lackluster September reading), the trend of lower supply and demand levels is clearly bleeding into the fourth quarter. That said, 2022 is still tracking to a record year for trade activity. Through September, trading volumes have totaled $636B, which not only represents an 8% increase over the same period last year but also the highest reading for any nine-month period. Furthermore, while slightly weaker, market breadth remained robust across the third quarter; an average of 1,530 loan facilities traded on a monthly basis. And while the average (93.6) and median trade prices (95.75) tested their lows of the year again in September, bid-ask spread levels remained range-bound across the quarter at 100 basis points. However, roughly one-third of September trade activity occurred on loans with bid-ask spreads wider than 100 basis points while 15% of activity transacted at a price point below 90.

For more information on the trading market, LSTA members can download the LSTA’s Third Quarter Secondary Trade Data Study.