November 16, 2023 - On Tuesday, the LSTA hosted its 17th annual Investing in the U.S. Loan and CLO Markets Conference in Tokyo, Japan. Nearly 600 attendees gathered at The Grand Hyatt in Roppongi Hills to hear veteran U.S. leveraged loan and CLO managers, arrangers and investors discuss their views on topics ranging from the future of private credit (and PC CLOs) to positioning loan and CLO portfolios to outperform through the credit cycle. In addition to the tasty spreads served throughout the day, the event offered plenty of food for thought.

The agenda kicked off with a fireside chat with investing guru and Oaktree Capital Management co-founder and co-chairman Howard Marks led by LSTA Executive Director Lee Shaiman. Marks spoke to themes from his recent investor memos, including the outperformance of credit relative to other asset classes amid a “sea change” in interest rates and the avoidance of mistakes (rather than the identification of winners) as the marker of success for investors. An afternoon keynote speech from economist and Morgan Stanley MUFG Securities Senior Advisor Robert Alan Feldman on Japanese policy responses to global macroeconomic challenges rounded out a series of panels.

Below, we recap the day’s takeaways. (Slides are available here.)

The panel lineup opened with a focus on the broadly syndicated loan (BSL) market. Panelists affirmed the loan market’s ability to outperform during rising rate environments, as evidenced by returns exceeding 10% since the Federal Reserve started raising interest rates in March 2022. They spoke to the core attributes of the asset class; namely, zero to no duration risk, negative correlation to U.S. Treasuries, and current double-digit yields.

They turned to the secondary market, where a recent bout of volatility sent loan prices off their 2023 highs. Panelists agreed the technical (excess demand/contracting supply) and fundamental (resilient economy/lower-than-projected default rates) outlooks suggest value exists in the secondary, which is now trading 500 bps below par.

Shifting to the primary market, panelists emphasized the third quarter’s surge in extension and repricing activity, punctuating a very productive year in terms of pushing out the majority of near-term maturities to 2028 and beyond.

With all the attention paid to direct lending and PC of late, a panel dedicated to this corner of the market seemed fitting. Panelists addressed the reasons for the rapid growth of PC, including the regulatory landscape fueling a shift from public to private markets, and attractive risk-adjusted returns. They highlighted the features of private loans compared to their broadly syndicated counterparts, including ease of execution in otherwise volatile markets, tighter documentation, and a single lender or small group of lenders to manage.

Panelists also noted the growth this year in PC CLOs as a byproduct of the rise of PC, focusing on the characteristics of the underlying loan collateral, including inter-manager diversification. Finally, the speakers weighed in on the strong performance of the asset class thus far and the impact higher rates may have on PC portfolios.

Speaking of potential defaults, the conference served up a lively panel about managing credit risk. Panelists began by discussing their expectations for interest rates to remain elevated into 2025. In turn, they expect the credit cycle will remain in the downturn phase for some time, with companies reporting declining EBITDA, lower interest and cash flow coverage ratios and default rates rising subsequently. However, they don’t expect default rates to spike meaningfully, given the availability of liquidity to lower-rated borrowers to provide runway through a challenging operating environment. Further, they noted that maturities have been pushed out and CCC-rated loan exposure remains manageable.

The panelists then pointed out that outperformance through the cycle will be dependent on sector allocation, as illustrated by evolving themes across sectors (including inflationary pressures) that have begun to drive dispersion in performance. Panelists highlighted the growth in the B- segment of the market, qualifying that 65% of existing loans rated B- were not downgrades, but rather were assigned that rating at syndication due to higher leverage as opposed to stressed operations.

In closing, panelists agreed that active portfolio management will be critical to outperformance over the next 12 months, with loss avoidance and the preservation of capital driving allocation and asset selection.

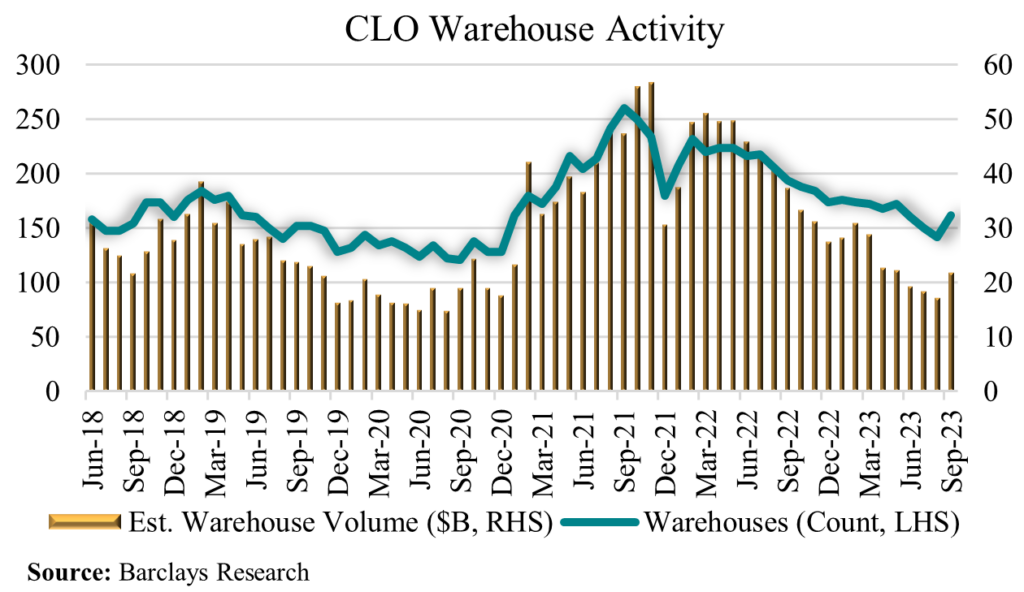

In other sessions, CLO arrangers, managers and investors shared perspectives on deal trends, the utility of the high-yield market and relative value in the CLO capital stack. The CLO dialogue launched with a comparison of BSL and PC CLO issuance, spreads and structures. BSL CLO issuance has been lagging, down roughly 27% year-over-year, according to Bank of America. In contrast, PC CLO issuance is about twice the same period last year. And while PC CLO outstandings and investment opportunities are expected to grow, panelists expect the stock of BSL AAA notes to shrink as post-reinvestment period CLOs begin amortizing.

Panelists acknowledged that PC CLO collateral is smaller, usually lower- (shadow) rated and less liquid, and less diversified. However, PC CLO liabilities enjoy more subordination at each level of the waterfall. Given the pros and cons – and recognizing that CLO AAA notes are nearly unbreakable – AAA investors in PC CLOs generally have been requiring a spread pick up of 30-40 bps.

A group of CLO managers considered the impact of today’s credit environment on active management strategies. They emphasized the need to optimize portfolios leading up to and through the end of the reinvestment period, particularly as the weighted average life test become more critical. Further, they affirmed that the CLO structure, given its many tests, is designed to protect investors.

Acknowledging the increase in ratings downgrades has brought CLO ratings baskets (namely the CCC basket) under pressure, the panelists argued that selling lower-rated assets for the sake of test compliance is not always in the interest of investors if the manager feels strongly that they are undervalued. They pointed out that credit ratings and credit quality are often conflated. Similarly, panelists asserted that the structure’s weighted average rating factor test is less indicative of portfolio risk than prices and spreads.

Additionally, they highlighted the functionality of bond buckets in actively managing CLOs. Each of the panelists on the manager panel noted they have used this tool to capitalize on the relative value in high yield bonds. Generally, they said, the Fed’s actions have prompted a shift among CLO managers away from credit risk in favor of duration risk to preserve and build par.

The day ended with a look at investing in CLOs. Panelists highlighted the value in AAA notes compared to other fixed income assets, remarking that while AAA spreads have tightened this year, AAA CLO notes offer the only scalable investment-grade product and spreads across AAA ABS notes have trended tighter this year.

Moreover, because they’re floating-rate, AAA CLO notes have been buoyed by higher interest rates. Even as a “higher-for-longer” environment increases default risk for leveraged loans, that risk is mitigated for AAA notes through because of the diversification and robust credit support the CLO structure provides. In fact, investment-grade CLO tranches have a cumulative default rate of 0.10%, as calculated by S&P.

The panelists dismissed the risks of a looming loan maturity wall and the share of CLOs exiting reinvestment. In reality, CLO buying capacity will drop only $45 billion. The panelists observed that private credit can help meet refinancing needs and that 2024 and 2025 maturities account for just 9% of the LSTA/Morningstar LLI.

Is Zen achievable in the loan market? It manifested itself at the Tokyo conference. It was an enlightening day that facilitated new connections and reengagement with old friends and colleagues. A big thanks to all participants – and for your hospitality, Tokyo! Until next year!