April 11, 2024 - As a source of permanent capital for alternative asset managers, Business Development Companies (BDCs) have proved to be very popular structures and BDC AUM represents a significant share of the private credit landscape. According to LSEG LPC, BDC AUM reached a new high of $315 billion at the end of 2023 – representing a 4% increase during 4Q23 and a 15% gain over the course of the year. Despite the popularity of BDCs – and the transparency BDCs afford – these vehicles are not well understood.

Recently, Dechert led an LSTA webcast on the “Nuts and Bolts of BDCs.” Harry Pangas, Partner at Dechert, moderated an expert panel, which included William J. Bielefeld, Partner, Dechert LLP; Larry Herman, Managing Director, Raymond James Investment Banking; Elizabeth Murray, Chief Financial Officer and Chief Operating Officer, Barings; and Eyal Seinfeld, U.S. Financial Services BDC Markets Leader, Ernst & Young LLP.

We have prepared a primer series on BDCs which unpacks the lessons in the “Nuts and Bolts of BDCs” webcast. Here, we will define some of the important key terms and recent trends.

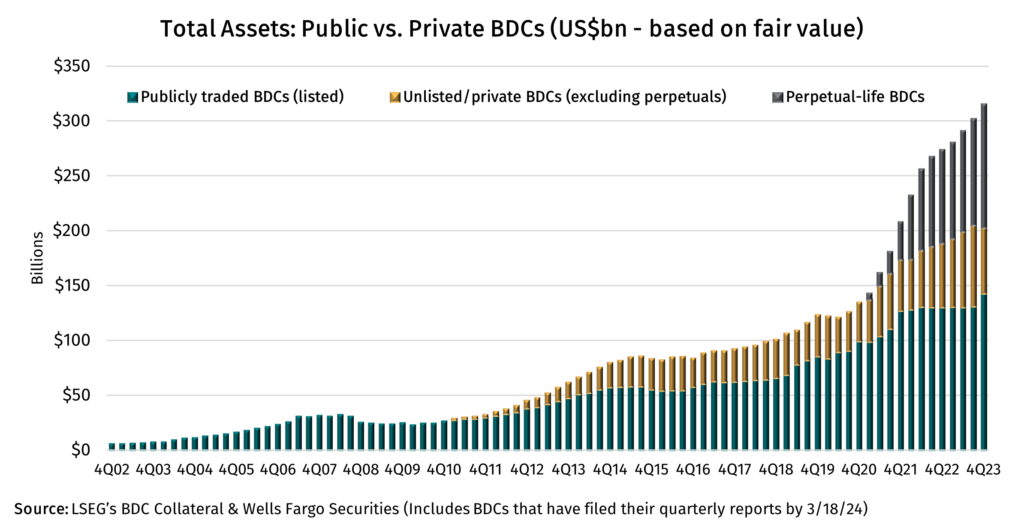

BDCs are a type of closed-end investment company established by Congress in 1980 with the goal of allowing retail investors to have access to private company investments. Originally envisaged as a vehicle for equity investments, BDCs have become a larger provider of debt capital. Chart 1 shows the growth in BDCs over the last 20 years.

There are three flavors of BDCs: publicly-traded BDCs, non-traded BDCs and private BDCs. The pros, cons and nuances of these structures will be addressed throughout the primer series. For our purposes here, we focus on the liquidity of their shares.

A traded BDC is a SEC registrant that lists its shares on an exchange, meaning that these BDC shares are the most liquid. A non-traded, publicly offered BDC is a SEC registrant, but its shares are unlisted and sold through continuous offerings up to a preset maximum. These shares may be offered on a monthly or quarterly basis. A private BDC is not listed on an exchange. Its shares are registered with the SEC and are typically sold through a private placement offering. Funding is effected through a capital call model. As the name suggests, a private BDC’s shares are the least liquid of the three structures. A private BDC may change its status over its lifetime – it is not uncommon for private BDCs to undergo an IPO process at a future date.

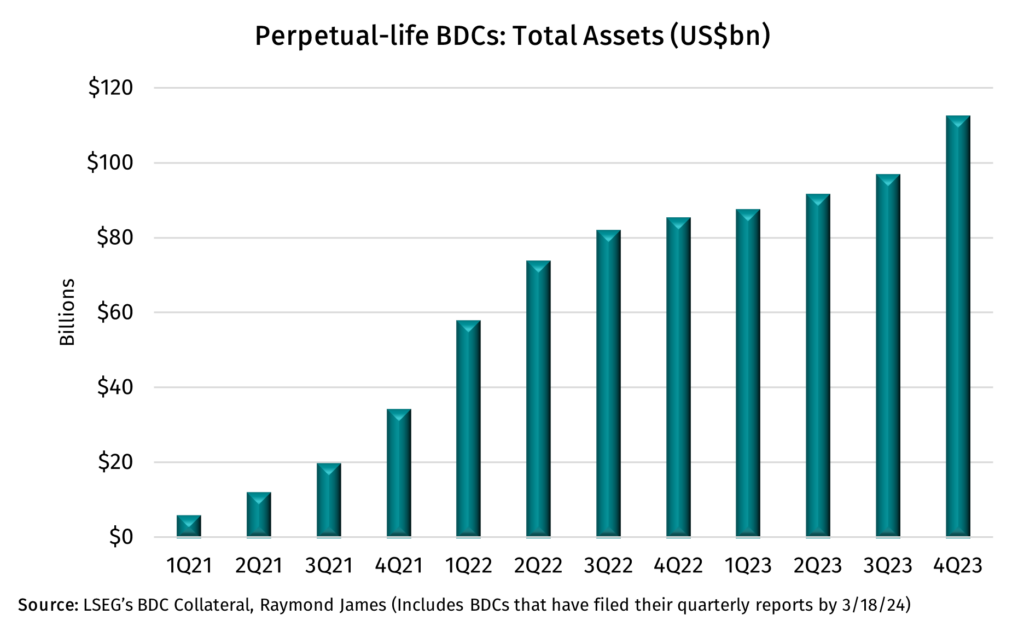

The primary determinant of a BDC’s structure is the manager’s targeted investor. Drilling down in the $315 billion AUM number for 2023, public BDCs have assets of $143 billion, with perpetual-life BDCs at $112 billion and private BDCs (excluding perpetuals) at $60 billion. You can see the growth of AUM across the three structures has picked up in the last three years. In particular, “untraded/private BDCs” which have gained favor as banks have pulled back. Chart 2 shines a light on the growth of the “perpetual-life BDC.”

This number represents most non-traded BDCs. This strategy entered the credit scene at the start of 2021 with the launch of the Blackstone Private Credit Fund (BCRED). In that time, BCRED’s assets have crossed $53 billion, with the perpetual-life strategy also proliferating across managers.

Part 2 will look at the regulatory scheme applicable to BDCs, including reporting requirements.